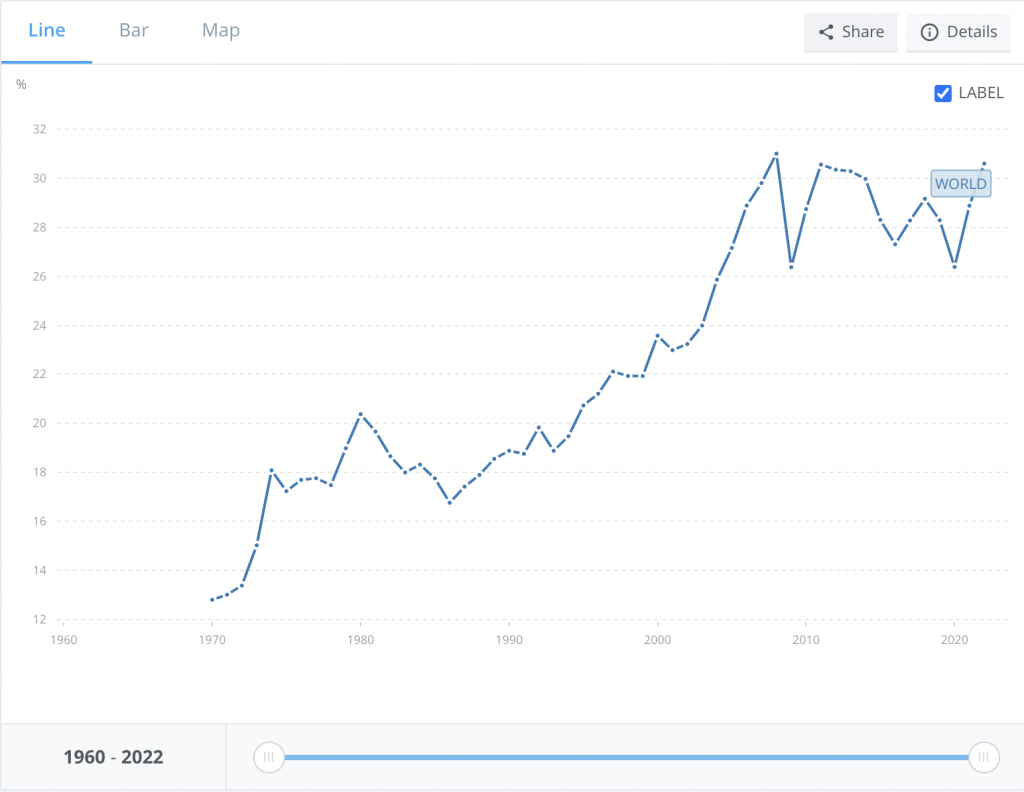

B2B payments and global’s export industry has experienced impressive growth over the years, despite a fourth quarter slump in 2022. In 2022, the world’s exports stand at US$30.98 trillion, marking a 9.98% increase compared to the previous year's figure of US$28.17 trillion in 2021.

Image source here

As businesses strive to capitalize on this expanding export market, a primary concern emerges: how can they efficiently collect global payments from their international businesses and marketplaces?

Many businesses today face several challenges when it comes to collecting B2B cross-border payments from their international businesses and marketplaces. One of the primary obstacles is unnecessary conversion fees, which can eat into profits and hinder financial efficiency. Additionally, excessive paperwork requirements can create delays and administrative burdens, further complicating the process of receiving international payments. Moreover, businesses often experience long waiting time when opening a bank account in any particular country. Overcoming these challenges is crucial for businesses to streamline their B2B global collection processes and ensure smooth and timely international money transfers.

The solution to collecting global payments from your international suppliers: SUNRATE

SUNRATE is a global payment and treasury management platform that assists businesses in simplifying the process of collecting B2B cross-border payments from international businesses and marketplaces. With SUNRATE, businesses can expect the following benefits:

To find out more about how you can start collecting global payments from international businesses and marketplaces, connect with us today.

Share to

Travel commerce spans borders, currencies, and multiple stakeholders — from customers and OTAs to hotels, airlines, and destination partners. Yet while bookings have become increasingly digital, payments lag at times, creating friction across the value chain. Why B2B Payments Have Become a Bottleneck in Travel Commerce Travel businesses face unique payment challenges compared to many other industries: • Suppliers and […]

Artificial intelligence is reshaping the financial services landscape—not only through customer-facing innovations, but also through the quiet transformation happening inside businesses. Findings from a white paper titled “AI and Stablecoins’ Transformation of the Global B2B Payments Experience” jointly released by FXC Intelligence and SUNRATE further underscore this trend. Across banking, fintech, consulting, legal services, and even government agencies, […]

As one of Asia-Pacific’s most advanced digital economies, South Korea has rapidly emerged as a key growth market for overseas sellers. In 2024, the country’s total online retail transaction value approached USD 170 billion, placing it among the top five e-commerce markets globally. With an internet penetration rate of 97.9%, near-universal online shopping adoption, and GDP per capita exceeding USD 36,000, South Korea […]

We hope to use cookies to better understand your use of this website. This will help improve your future experience of accessing this website. For detailed information on the use of cookies and how to revoke or manage your consent, please refer to our < privacy policy >. If you click the confirmation button on the right, you will be deemed to have agreed to use cookies.